Butler County Commissioners hear from Elderly Services Program, announce fourth summit

The November election is still five months away, but one Butler County group is already looking ahead to 2025 to place a levy on the ballot to ensure older people remain independent in their homes.

The November election is still five months away, but one Butler County group is already looking ahead to 2025 to place a levy on the ballot to ensure older people remain independent in their homes.

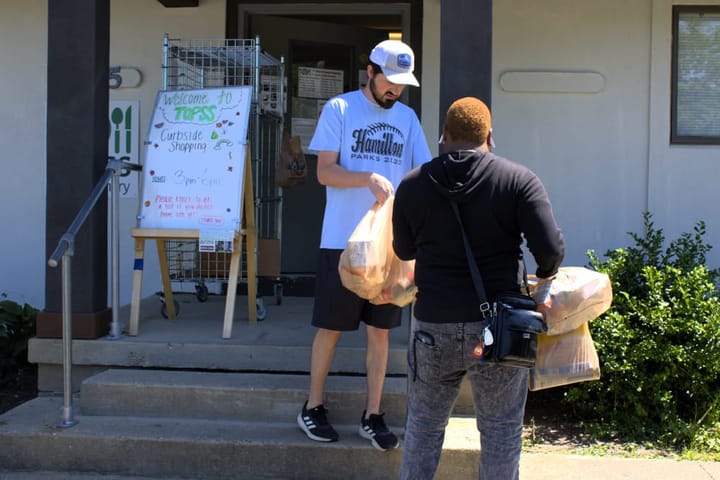

Members from the Elderly Services Program (ESP) presented their 2023 annual report at the Butler County Commissioners meeting Monday, June 17. Ken Wilson, vice president of programs and business operations and member of the Council on Aging in southwestern Ohio, and Nan Cahall, government relations director at the Council on Aging, proposed to initiate a conversation for a new levy for the 2025 ballot.

Cahall said 90% of the program is currently funded by the Butler County Senior Services tax levy and served 4224 older adults in 2023. The ESP provides services such as meals, help with personal care, transportation to medical appointments, respite care for family caregivers and more.

"Without this program, many older adults would find it necessary to move into a nursing home," Cahall said. "They would lose their independence, their privacy and their connection to home and community."

Wilson said to be eligible for the program, a person must be a resident of Butler County, more than 60 years old and unable to perform daily activities without help.

"For many reasons such as work and other family responsibilities, family caregivers are often unable to provide all the care of their loved ones need," Wilson said. "And for older adults who have no one that lives nearby, this program is their lifeline."

Butler County first passed its 1-mill elderly services levy in 1996, before increasing it in 2001 and again in 2005 to a 2-mill levy. Since then, the levy has been renewed every five years at the same amount. In 2020, the levy passed with 77% support, and it currently costs homeowners $39.81 each year per $100,000 in home valuation.

Last week, the commissioners also heard a proposal to put an increased mental health and addiction resources levy on the ballot this November.

During Administrator Judi Boyko's report, she said the commissioners will hold their fourth summit with state legislators and other elected county officials to continue their discussion on property tax valuation reform and review on Monday, June 24.

Boyko said she believed the state created a joint committee assembly of the Ohio House of Representatives and Senators because of the commissioners insistence and efforts on evaluating property taxes 18 months ago.

"We will be meeting with those state legislators hopefully to get a status report and a summary of the joint committee, the efforts it's made so far and what it intends to do toward the end of the year," Boyko said.

Boyko also presented a resolution by the courts juvenile court. They're requesting authorization to apply for the fiscal year 2025 reclaim grant update for nearly $2.3 million.

"It's for the prevention, treatment and rehabilitation programs for alleged or adjudicated unruly and delinquent youth or children at risk of becoming unruly or delinquent," Boyko said.

After the regular session on Monday, 9:30 a.m. June 24 in the Butler County Government Services building, 315 High St. there will be a work session on property taxes and reform.